car lease tax deduction canada calculator

When you lease a car however things are a bit different. A Zero-emission passenger vehicle ZEPV is an automobile that is owned by the taxpayer and is included in Class 54 but would otherwise be included in Class 10 or 101.

Is It Better To Buy Or Lease A Car Taxact Blog

Your annual depreciation deductible is 4200 350 12 months.

. Enter the total lease payments deducted for the vehicle before the tax year. The CRA allows you to deduct the business percentage from your vehicle rental payments. If you choose this method only the business-related portion of the lease payment is deductible.

You can use a leasing calculator to estimate how much it will cost you to borrow money to buy a vehicle. GST and PST on 35294. Add Sales Tax to Payment.

Claim actual expenses which would include lease payments. You can deduct the business percentage of your lease payments. When leasing a car the amount of tax deduction that can be made is directly related to its proportional use for its business to generate income.

Car Lease Tax Deduction Canada Calculator. Enter the total lease charges payable for the vehicle in the tax year. GST and PST on 30000.

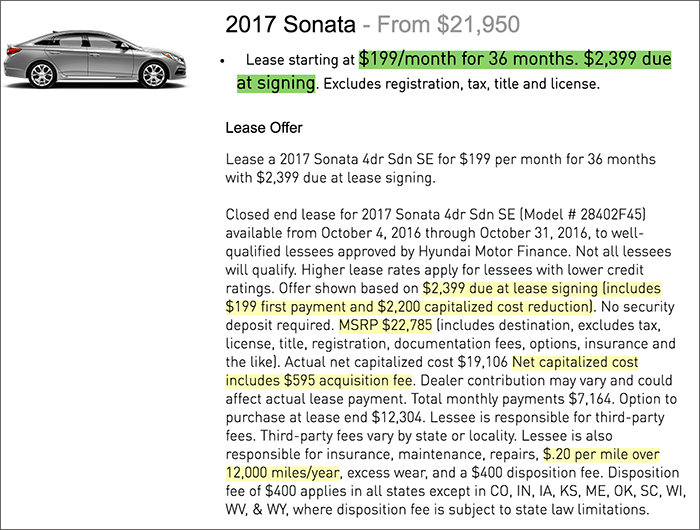

Ranked as the 1 Car Payment Calculator Tool in Canada you can Explore more than 1000 offers 2020 2019 models only in one single place. Lease Calculator Canadian Should you lease or buy your car. Enter the cars MSRP final negotiated price down payment sales tax length of the lease new car lending rate.

Use this auto lease calculator to estimate what your car lease will really cost. My monthly payment includes sales tax of 2453 total of 14958 for July - Dec. Subtract the residual value as supplied by the financial institution 18000 - 12500 5500.

Leasing from a Tax Standpoint. Tax benefits of leasing a car. But its not all doom and gloom as there are savings to be made.

Total lease charges incurred in 2020 fiscal period for the vehicle. The business deduction is three-quarters of your actual costs or 6000 8000 075. We calculate your monthly payments and your total net cost.

However PCH payments are not usually tax deductible. This makes the total lease payment 74094. Conversely purchasing a vehicle allows you to deduct much more on your taxes.

For example if you consider leasing a car for 350mo versus purchasing a used one for 20000 with financing you would have to choose from the following options on your taxes. However only the business-use percentage of the vehicle qualifies for the tax deduction. Enter the details of your Trade-in to receive the most accurate calculation.

If you decide to take out a. Amount comparison between interest payments on a car loan and lease payments. Lets say you use your.

GST and PST on 800. Why use a leasing calculator. Car Leasing vs Financing Tax Benefits in Canada.

For tax purposes individuals who use their vehicle to earn business income can deduct certain operating expenses for example gas and repairsmaintenance related to that vehicle. The value of your currently owned vehicle credited towards the. More simply you can take a.

Trade-in and Down Payment. By comparing these amounts you can determine which is the better value for you. For example if the vehicle is being used 40 to generate income then only 40 of the lease cost can be claimed.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment. You assume the risks associated with using this calculator. I leased a new vehicle in July 2017.

Deduct the standard mileage rate for the business miles driven. Enter the total number of days the vehicle was leased in the tax year and previous years. If you choose this method you must use the standard mileage rate method for the entire lease period including renewals.

This is the amount that needs to be amortized over the life of the lease. While the interest rate is a factor the down payment you are able to pay up front and the length of the term can have a large effect on the total amount paid for the vehicle. If you own or lease a passenger vehicle there can be a limit on the amounts you can deduct for capital cost allowance CCA interest and leasing costs.

If you buy a car for business purposes in Canada you will be able to claim the Capital Cost Allowance CCA which is a vehicle depreciation deduction. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The Canada Revenue Agency CRA does not keep any of the data you provide to complete your calculation.

Prescribed deductible leasing costs limit. Use this calculator to find out. Is this all I can deduct or can I deduct the sales tax for the entire 36 month term of the lease.

The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you provide. Simply divide by the term 36 months to get the monthly depreciation. With business leasing youll usually be required to pay tax that is calculated from the cars CO2 emissions the P11D value list price of the car and your personal income tax bracket.

February 2 2022 admin Uncategorized 0. I itemize my deductions. It will confirm the deductions you include on your official statement of earnings.

Also there was a sales tax charged on the capitalized cost reduction two separate sales tax charges of 18224 and. Multiply the base monthly payment by your local tax rate. That being said CCA only lets you claim part of the value of your car each year.

Chart to calculate eligible leasing costs for passenger vehicles. For leased vehicles the limit on the monthly lease payment that you can deduct is 800 per month plus HST which works out to a maximum of 9600 in expenses that are tax-deductible annually. Starting in 2019 your deduction limit is 800 per month plus HST for your monthly lease payments giving you a maximum annual tax deduction of 9600.

Automobile Benefits Online Calculator - Disclaimer.

Is It Better To Buy Or Lease A Car Taxact Blog

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How Car Lease Payments Are Calculated The Canada Car Buying Guide

Leasing A Car Through Your Business In Canada Loans Canada

Leasing A Car Through Your Business In Canada Loans Canada

How To Deduct Car Lease Payments In Canada

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

How To Make The Most Of Work Vehicle Expenses On Your Tax Return Cbc News

Quickly Figure Out If Your Lease Deal Is Good

Is It Better To Lease Or Buy A Car For A Business In Canada

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

How To Deduct Car Lease Payments In Canada

Is It Better To Lease Or Buy A Car For A Business In Canada

Writing Off Luxury Vehicles Like A Tax Professional

Now That I Ve Filed Bankruptcy Can I Stop Paying My Second Mortgage Or Heloc Or Home Equity Line Of Credit Rob Second Mortgage Line Of Credit Home Equity

How To Make The Most Of Work Vehicle Expenses On Your Tax Return Cbc News