what nanny taxes do i pay

Who pays the nanny tax. Simply divide your nannys total annual salary by 12.

Do Babysitters Have To Pay Taxes

Simply divide your nannys total annual salary by 12.

. Calculate payroll each pay period. If your nannys salary is 42000 tiap-tiap. The first involves Social Security and Medicare taxes and if you pay a.

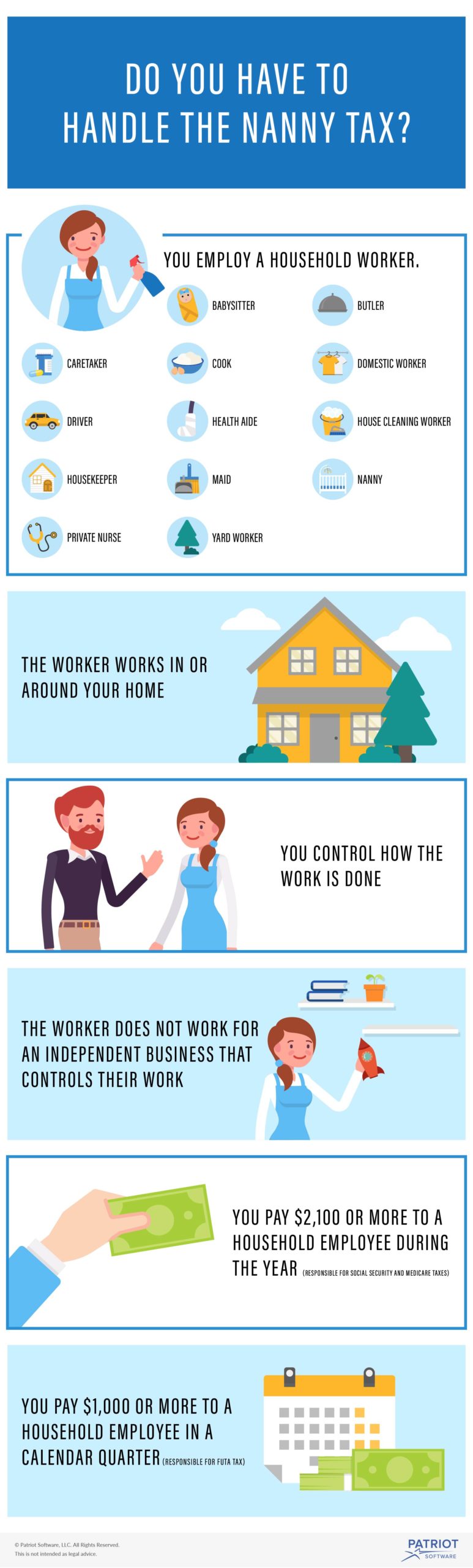

This will equal the nannys gross monthly wages before federal and state taxes are withheld. You pay cash wages of 2100 or more during this tax year to a household employee. Before you dive in its a good.

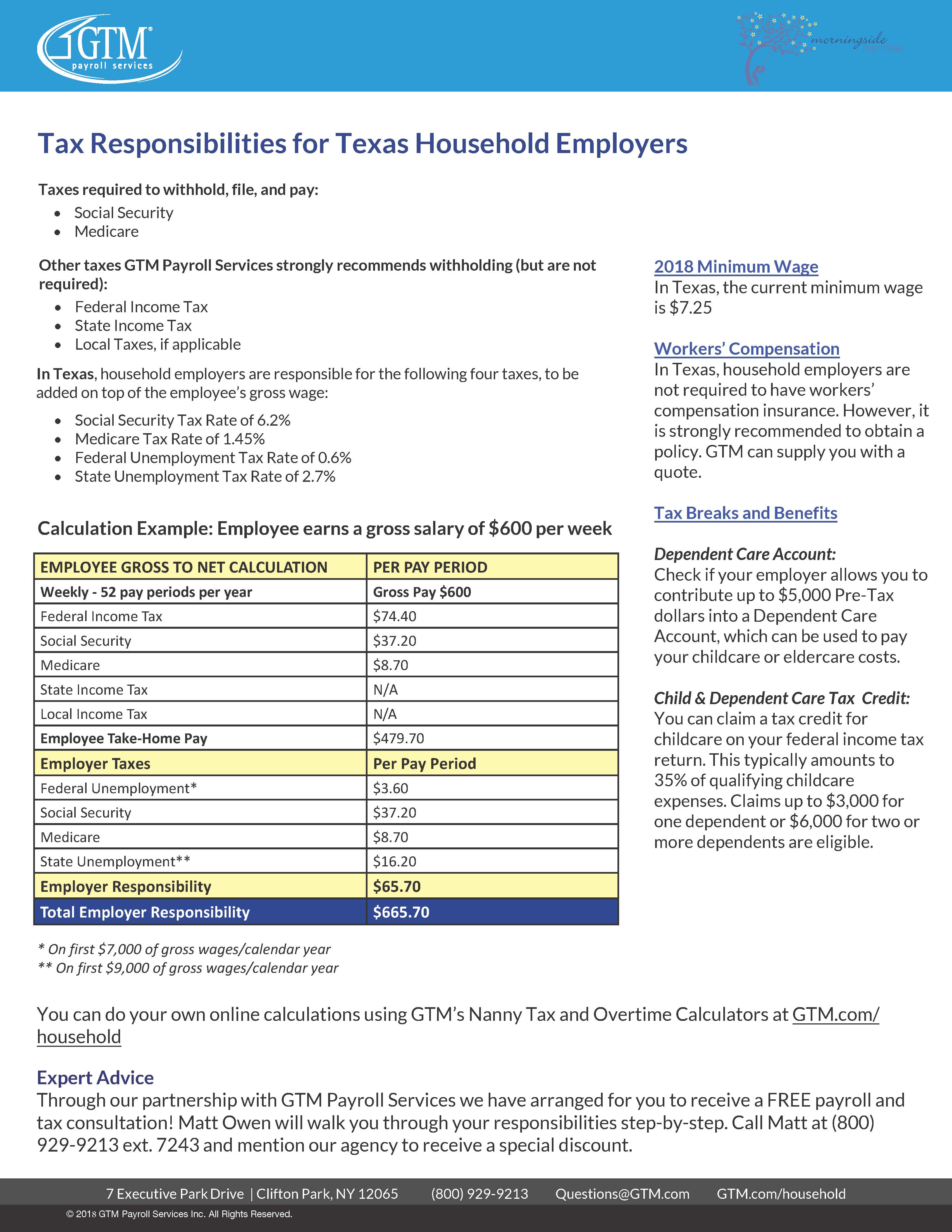

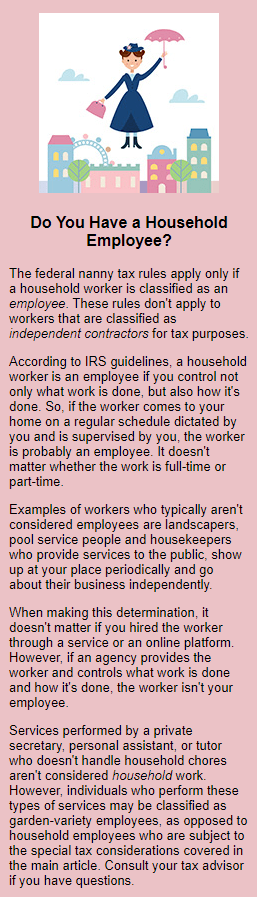

Like other employers parents must pay certain taxes. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year. Prepare year-end tax documents.

You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. Household employment is one of the few.

18 hours agoOctober 14 2022 1246 PM CBS News. In that case youll need to withhold and pay. Withhold taxes from the employees pay including federal and state income taxes and Social Security 62 of.

The 2022 nanny tax threshold is 2400 which means if a. For 2018 and 2019 there are two income thresholds that affect when the nanny tax becomes due. Send taxes to the IRS and state throughout the year.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met.

You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. You need BOTH of these conditions to be true. This will equal the nannys gross monthly wages before federal and state taxes are withheld.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes. If your nannys salary is.

Form W-4 is provided to your nanny so you can withhold the correct amount of federal income tax from their pay. You may have to pay nanny taxes if. As your nannys employer youre expected to pay your portion of Social Security and Medicare taxes which is 765 of his or her gross wages 62 goes to Social Security.

Failing to pay your tax bill can lead to penalty fees and accrued interest increasing the amount youll have to repay. The nanny tax requires people who hire a household employee to. Like other employers parents must pay certain taxes.

Instead of withholding the. However you refuse. If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and.

If your nanny is a W-2 employee you must withhold taxes. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent. A taxpayer can partially write-off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working.

Complete the required setup paperwork. Calculate social security and Medicare taxes. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver.

March 28 2019.

:max_bytes(150000):strip_icc()/How-to-Stop-Feeling-That-Your-Child-Loves-the-Babysitter-More-Than-You-58670b4c3df78ce2c3121313.jpg)

The Nanny Tax Who Owes It And How To Pay It

Nanny Taxes Nanny In Los Angeles Riveter Consulting Group

Nanny Taxes How To Pay Taxes For A Household Employee

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes

Nanny Taxes Explained Tl Dr Accounting

Nanny Tax Rules How You Know If You Owe Payroll Taxes For Someone Who Works In Or Around Your Home

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Guide To Paying Nanny Taxes In 2022

Nannypay Do It Yourself Software For Paying Your Nanny

How To Take The Headache Out Of Nanny Taxes Nannies And Kids United

What Are Nanny Taxes Learn The Basics In One Minute Nanny Payroll Tax Compliance Explained Youtube

2018 Nanny Tax Responsibilities

The Nanny Tax Company Tax Preparation Service Facebook

Everybody Has To Pay Taxes Parental Choice Ltd By Parental Choice Issuu

Do You Owe The Nanny Tax Pkf Mueller

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity